Money has been an integral part of human history for centuries and its evolution is an interesting subject to explore. The history of money dates back to ancient times and encompasses an array of different forms and functions. Money has traditionally been used as a medium of exchange and a store of value, and its use has been documented across a variety of ancient societies.

Money has also evolved over time. Throughout history, people have used a variety of different objects as money, from shells and beads to coins and paper currency. Money has served as a medium of exchange, a store of value, and a unit of account, and its use has enabled trade, investment, and economic growth.

When was money invented?

The exact date when money was invented is unknown, but it is believed to have been used in ancient societies as far back as 2000 BCE. In ancient societies, people used objects such as shells and beads as a medium of exchange. These were known as “commodity money” and were used to facilitate trade.

In 650 BCE, the first coins were minted in the kingdom of Lydia (present-day Turkey). These coins were made from a mix of gold and silver and were used as a form of currency. Coins soon became a widespread form of currency throughout the ancient world and were used in many different societies.

How has money evolved over time?

The evolution of money has been a long and complex process, with different forms of money being used in different societies throughout history. In ancient societies, money was often tied to a commodity, such as gold or silver. This was known as “commodity money” and was used as a form of currency.

As societies evolved, coins and paper currency began to be used as a form of money. Coins were made from metals such as gold, silver, and copper and were used as a medium of exchange. Paper currency was also introduced in certain societies and was used as a form of currency.

In the modern era, money has evolved to include digital forms of currency, such as cryptocurrency. Digital currency is not tied to any physical commodity and is instead based on cryptography and computer algorithms. This form of currency is becoming increasingly popular and is used by many people around the world.

Here is a brief timeline of how money evolved during centuries:

1. Barter System (Prehistoric Times – Ancient Civilizations)

Before the advent of money, people engaged in barter trade, exchanging goods and services directly. This system had limitations as it required a double coincidence of wants. For example, a farmer might trade his crops for a blacksmith’s tools, but this process was inefficient.

2. Commodity Money (Ancient Civilizations – Middle Ages)

Commodity money emerged as a solution, where items with intrinsic value were used as a medium of exchange. Common commodities included salt, cattle, and precious metals like gold and silver. The Lydians are credited with creating the first gold coins around 600 BCE.

3. Metal Coins (7th Century BCE Onwards)

Metal coins became a standardized form of currency in various civilizations. The Chinese, Greeks, and Romans minted coins with standardized weights and designs, facilitating trade across regions.

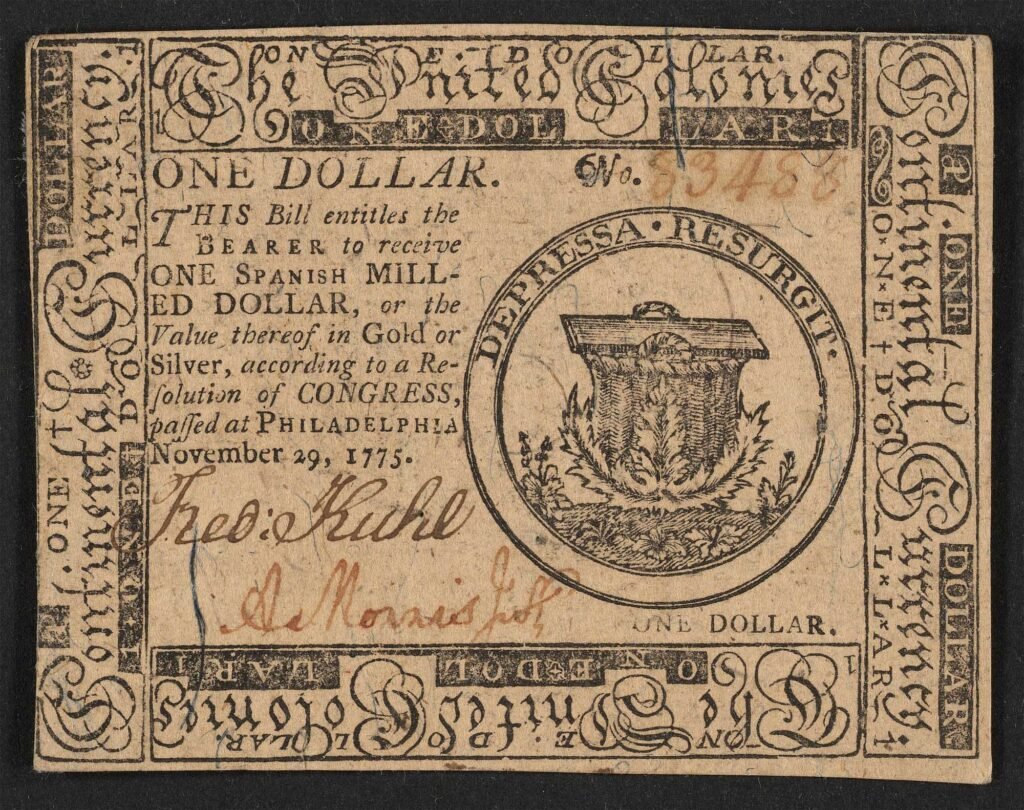

4. Paper Money (7th Century CE – China)

The concept of paper money originated in China during the Tang Dynasty (7th century CE). Merchants used promissory notes for trade, and the Chinese government later issued official paper money. Marco Polo, the Venetian explorer, was intrigued by this system during his travels in the 13th century.

5. The Gold Standard (17th – 20th Century)

Countries began tying their currency to a specific amount of gold, creating the gold standard. This system aimed to provide stability to currencies, with each unit representing a fixed quantity of gold. The United Kingdom formally adopted the gold standard in 1821, and it became widespread during the 19th century.

6. Fiat Currency (20th Century Onwards)

As the gold standard proved impractical during economic crises, many countries transitioned to fiat currency. Fiat money has no intrinsic value but is declared legal tender by the government. The U.S. abandoned the gold standard in 1971 under President Richard Nixon.

7. Cryptocurrency (2009 Onwards – Bitcoin)

The 21st century witnessed the rise of digital currencies, with Bitcoin being the first decentralized cryptocurrency created in 2009 by an individual or group using the pseudonym Satoshi Nakamoto. Cryptocurrencies operate on blockchain technology, providing decentralized and secure transactions.

The influence of money in modern societies

Money is an important part of modern societies and is used for a variety of different purposes. Money is used as a medium of exchange, a store of value, and a unit of account, and is used to purchase goods and services. Money is also used as a form of social status, with wealthy individuals having access to more money and more power.

The use of money has enabled economic growth and expansion, and has enabled people to invest in businesses and other ventures. Money has also enabled governments to finance infrastructure projects, fund public services, and manage their economies.

The role of governments in money creation

Governments play an important role in money creation and control. Governments have the power to create money in the form of paper currency and coins, as well as through digital currency. Governments also have the power to set the exchange rate and control the flow of money in and out of the economy.

The amount of money in circulation is determined by the central bank, which is responsible for setting monetary policy. The central bank also has the power to control the money supply through the use of interest rates and other measures.

The effects of money printing and control

The effects of money printing and control are far-reaching and can have a significant impact on the economy. Money printing and control can lead to inflation, deflation, and other economic problems. Inflation is caused when too much money is printed, causing prices to rise. This can lead to a decrease in purchasing power and can lead to economic instability.

Deflation is caused when too little money is printed, causing prices to fall. This can lead to a decrease in economic activity, as people have less money to spend. Money printing and control can also lead to currency devaluation, which can have a negative effect on the economy.

Controversies of States Printing Money

The practice of states printing money, often referred to as monetary or currency printing, has been a subject of controversy throughout history. While the issuance of currency is a fundamental aspect of economic management, it has been the source of various debates, crises, and concerns. Here’s an exploration of the controversies surrounding states printing money, including historical events and notable debates:

1. Hyperinflation and Economic Crises

One of the most significant controversies is the potential for hyperinflation, a situation where the value of a country’s currency rapidly and uncontrollably decreases. A notorious historical example is the Weimar Republic in Germany during the early 1920s. The excessive printing of money to finance war reparations led to hyperinflation, with citizens experiencing skyrocketing prices and the currency becoming virtually worthless.

2. Zimbabwe Hyperinflation (2000s)

In the 2000s, Zimbabwe experienced one of the most extreme cases of hyperinflation in modern times. The government, facing economic challenges and political instability, resorted to printing increasingly large denominations of its currency. This resulted in astronomical inflation rates, reaching an estimated 89.7 sextillion percent in November 2008. The Zimbabwean dollar ultimately became obsolete, and the country abandoned its own currency in 2009.

3. Quantitative Easing and the Global Financial Crisis (2008)

During the 2008 global financial crisis, major central banks, including the U.S. Federal Reserve, employed unconventional monetary policies, such as quantitative easing (QE). This involved massive purchases of financial assets and injecting liquidity into the financial system by creating new money. While QE was intended to stabilize economies, it sparked debates about its potential long-term consequences, including inflationary pressures and concerns about asset bubbles.

4. Modern Monetary Theory (MMT)

Modern Monetary Theory is a contemporary economic framework challenging conventional views on government spending and money creation. Advocates argue that sovereign nations with their own currency have more flexibility in managing fiscal policies, including deficit spending and printing money. Critics, however, express concerns about the potential for inflation and the impact on economic stability.

5. Public Debates on Central Bank Independence

The autonomy of central banks in managing monetary policy is a frequent topic of public debate. Critics argue that political pressures may lead to excessive money printing for short-term gains, potentially compromising long-term economic stability. Central bank independence is seen as a safeguard against such pressures, ensuring that monetary decisions are made based on economic fundamentals rather than political considerations.

6. Digital Currencies and Central Bank Digital Currencies (CBDCs)

As technology advances, the concept of central bank digital currencies (CBDCs) has gained attention. Some argue that CBDCs could provide more efficient and transparent monetary systems, while others express concerns about privacy, surveillance, and the potential for even greater control over the money supply by central authorities.

The controversies surrounding states printing money are deeply intertwined with historical events, economic theories, and public policy debates. The balance between ensuring economic stability and avoiding the pitfalls of inflation and currency devaluation remains a central challenge in the management of monetary systems worldwide.

The future of money

The future of money is uncertain, but it is likely that digital forms of currency will continue to play an increasingly important role in the global economy. The use of digital currency is becoming more widespread and is likely to become the dominant form of money in the future.

In addition, the use of blockchain technology is likely to become more widespread in the future. Blockchain technology allows for the secure transfer of digital assets and is used for a variety of different applications, including cryptocurrency transactions.

While the future of money promises exciting advancements, it also presents challenges and ethical considerations. Issues such as privacy concerns, regulatory frameworks, and the environmental impact of energy-intensive blockchain networks must be addressed. Striking a balance between innovation and responsible development is paramount to ensure that the future of money aligns with societal values and meets the needs of a diverse global population.

In essence, the future of money is a dynamic landscape shaped by technological breakthroughs and societal demands. As we navigate this digital frontier, a thoughtful and inclusive approach is essential to harness the transformative potential of emerging technologies while addressing the challenges that accompany this evolution in our monetary systems.

Leave a Reply